The financial markets experienced a sudden shift on Monday, with shares of Trump Media & Technology Group Corp (NASDAQ: DJT) skyrocketing in pre-market trade. This rise followed a weekend characterized by what investigators believe was an assassination attempt on former US President Donald Trump.

The Incident

On Saturday evening, during a rally in Butler, Pennsylvania, Trump was shot by a shooter on a nearby roof. The former president was in the middle of his speech when several gunshots rang out. Trump, who had been wounded in the ear, swiftly fell to the ground as Secret Service members rushed to protect him.

The demonstration became violent when further gunshots were reported, killing one attendee and critically injuring two others. Law police officers on the site neutralized the shooter, Thomas Matthew Crooks.

Despite the mayhem, Trump raised his fist and mouthed the word “fight” three times, encouraging the audience before being led offstage. The incident prompted calls for a probe into the Secret Service’s security arrangements at the event.

Market Reaction

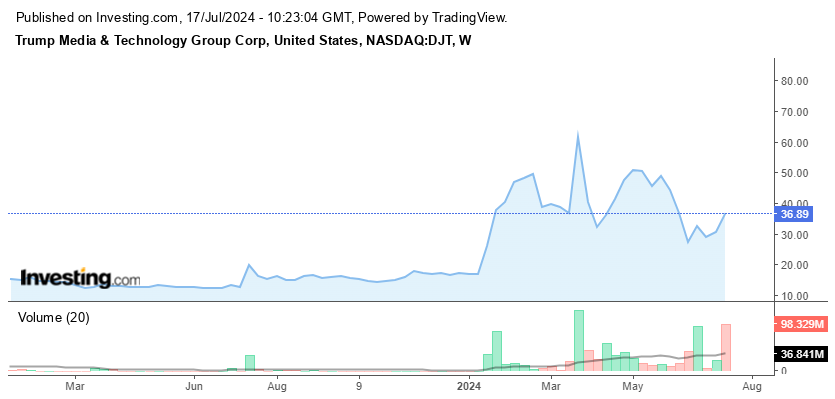

In response to the attempted assassination, DJT shares skyrocketed, trading 60% higher in pre-market trading and reaching a high of 74% at one time. If these increases continue, DJT’s value could rise from $5.87 billion to roughly $9.5 billion when the market opens. This rise demonstrates Trump’s strong market sentiment and support, as he prepares to accept the Republican National Convention’s 2024 presidential nomination this week.

Long-Term Impact

The instant increase in DJT shares demonstrates investor confidence in Trump’s durability and influence over the company he established. However, the long-term impact of this incident on DJT stock and the larger market is unknown and will rely on various factors:

Security Measures and Political Stability: The market will closely monitor how the Secret Service and other authorities handle this situation. Improved security measures and political stability will be critical to preserving investor trust.

Trump’s Political Future: As Trump prepares to accept the Republican nomination, his political trajectory will have a huge impact on DJT stock. A successful campaign could boost investor confidence, whereas losses could have the reverse impact.

Public and Investor Perception: How the public reacts to the incident, as well as Trump’s response, will have a significant impact on investor perception. Trump’s ability to rally supporters and display strength in the face of adversity should benefit DJT stock.

Economic Indicators: DJT’s stock will be influenced by broader economic indicators and market developments. Inflation, interest rates, and general market performance will all have to be taken into consideration.

Conclusion

The attempted assassination of Donald Trump has clearly made a big ripple in the financial markets, with DJT stock rising sharply. While the initial market reaction was good, the long-term impact will be determined by a number of factors, including political stability, Trump’s campaign performance, and larger economic trends. To handle the potential volatility that lies ahead, investors must remain watchful and actively monitor developments.